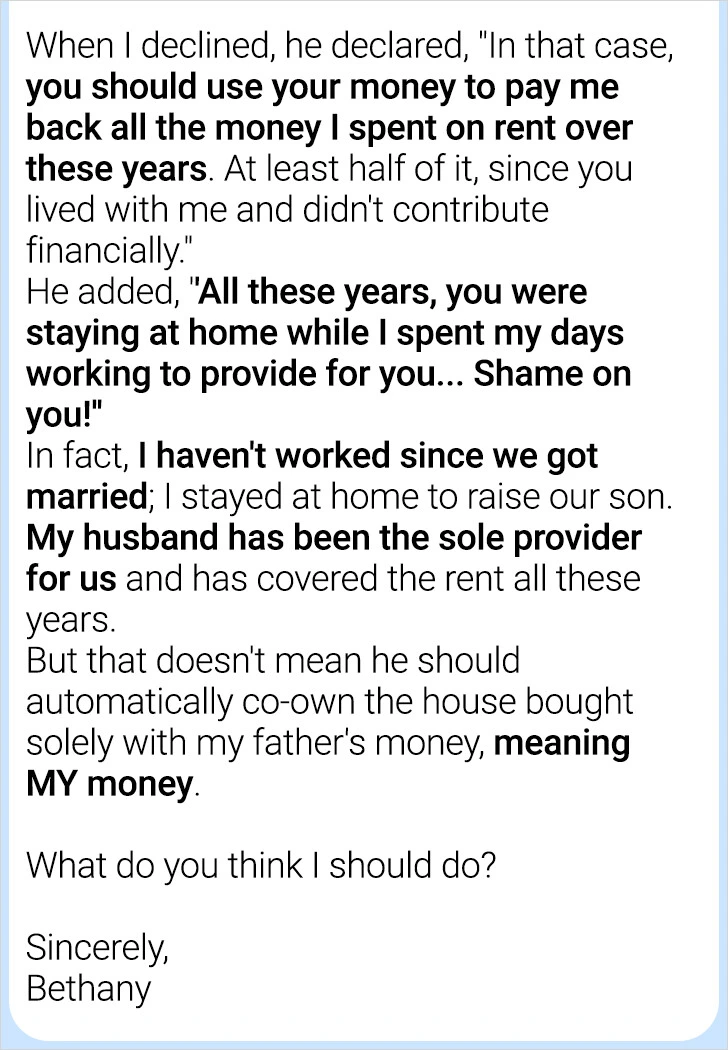

Money matters can often spark disputes, even within the most intimate relationships. Bethany is now in a position to buy her own house, but she adamantly opposes the idea of allowing her husband to co-own it since it was purchased using her family’s funds. This decision has caused tension between them, and his reaction has left her feeling unsettled. Consequently, she has turned to us for guidance.

Bethany’s letter:

Thank you for entrusting us with your story, Bethany! We’ve compiled some tips that we hope will prove helpful to you.

Consult with a legal professional.

Given the intricacies of your situation, it’s imperative to seek counsel from a lawyer specializing in inheritance and property law. Such an expert can offer personalized advice on navigating the legal aspects of your inheritance, and safeguarding your rights and preferences.

Grasping your legal position will equip you with the knowledge needed to make informed choices regarding the purchase of the house.

Transparent dialogue.

Have a sincere conversation with your husband about your feelings regarding the inheritance and house purchase. Express gratitude for his support while explaining the inheritance’s personal significance. Brainstorm compromises, like drafting a clear ownership agreement, to address both your concerns and needs.

Think about therapy.

In situations involving money, inheritance, and relationships, emotions can escalate quickly. Seeking the assistance of a couples therapist or counselor can be beneficial. They can facilitate constructive discussions and offer guidance on navigating this challenging period together.

A neutral third party can provide valuable insights and strategies for resolving conflicts and enhancing your relationship while making crucial decisions about your future.

Investigate equitable finances.

Even though your husband has been the primary breadwinner, it’s crucial to acknowledge the worth of your contributions to the household, such as caregiving and homemaking.

Talk to your husband about the concept of fair recompense for your non-financial efforts over the years. This might mean discussing an equitable distribution of assets or finding ways for you to have a share in the new home that reflects both your financial and non-financial inputs to the family.

Kate, like many others, is grappling with financial disagreements in her marriage. Her husband is unwilling to contribute to his stepson’s tuition fees, yet intends to splurge on an extravagant car for their daughter’s 16th birthday. Feeling the weight of this inequality, Kate has sought our counsel.